The Sustainable Infrastructure Imperative and the Role of Carbon Pricing in Igniting a Global Transformation

The global community set itself an ambitious agenda in 2015, through the Sustainable Development Goals and the Paris Agreement. The question facing us now is how to turn this ambition into action, while also achieving economic growth.

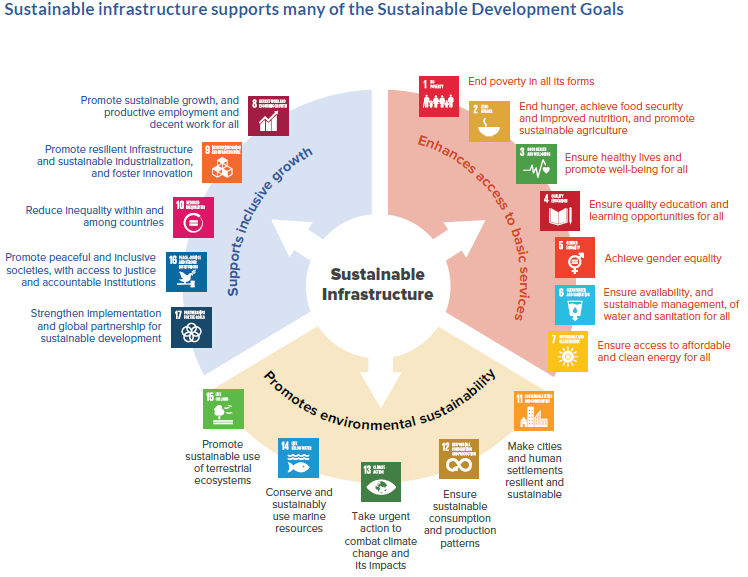

Today, the Global Commission on the Economy and Climate, a major international initiative led by 24 former heads of state and finance ministers, heads of international organisations, and business leaders, launches its third major report. The report argues that sustainable infrastructure lies at the heart of meeting this challenge, through enabling cities with better air quality and connectivity, ecosystems that are robust and resilient, and energy systems that can curb dangerous climate change.

The report provides a road-map of specific actions in four key areas to help finance and deliver on sustainable infrastructure.

The first is tackling price distortions, which includes reforming subsidies, and also, importantly, setting a price on carbon. Previously, the Commission has recommended that governments introduce or strengthen carbon pricing by 2020. This report reaffirms the fundamental importance of establishing strong and effective carbon pricing.

The other three action areas of the road-map for sustainable infrastructure are: strengthening policy frameworks and institutional capacities to help deliver the enabling conditions for investment, to build pipelines of projects and to attract private investment; transforming the financial system to deliver the scale and quality of investment needed in order to augment and catalyze financing from all sources; and boosting investments in clean technology R&D and deployment to reduce the costs and enhance the availability of sustainable technologies.

Carbon pricing is in fact a cross-cutting element of this whole agenda. It can help catalyze investment in the sustainable infrastructure needed to achieve global goals in three ways.

First, strong, predictable and rising carbon prices send an important signal to markets, helping to align expectations on the direction of change, thereby steering consumption choices and the type of investments made in infrastructure. This can help to accelerate and scale up investments in more efficient and innovative products, new markets, new business models and jobs, and more productive ways of working and operating.

Second, carbon prices (set through broad-based taxes or cap-and-trade systems) are an economically efficient way to tackle the greenhouse gas market failure. Evidence from the electricity sector indicates that these have been the cheapest policies to reduce emissions. Analysis conducted for the Commission shows that carbon price in 2030 of US$75 per tonne of CO2e in developed countries and US$35 per tonne of CO2e in developing countries, on average, could see annual emissions in 2030 reduced by 2.8–5.6 Gt of CO2e.

Third, pricing carbon right can raise fiscal revenues that can be put to productive uses. This is especially critical for meeting our development objectives, including providing basic services such as sanitation, education and affordable transport opportunities. Together with complementary action on reforming fossil fuel subsidies, pricing carbon can divert funds towards more progressive uses that benefit the worst off.

Recent progress on carbon pricing is encouraging, with around 40 countries and more than 20 cities, states and regions, including 7 of the top 10 economies, having implemented or scheduled an explicit price on carbon. Together they cover an estimated 7 Gt CO2e, triple the coverage a decade ago. But this is only 13% of annual GHG emissions. Similarly, over 1,200 companies are now using or planning to use a carbon price, a 20% increase from a year ago. But the participation from outside of the European Union and the United States is limited, especially when it comes to low-income and emerging economies where around 70% of infrastructure investments will be made over the next 15 years.

In this new report, the Global Commission welcomes the emerging coalitions of governments, investors and businesses – including through the Carbon Pricing Leadership Coalition and the G20 – that have the potential to accelerate action globally on fossil fuel subsidy reform and carbon pricing, including by highlighting evidence of good practice and building multi-stakeholder partnerships for reform.

Over the past few years, the world has experienced a pivot in ambition on climate and development goals, with stakeholders from across the board starting to take action. But the challenges we face require an unprecedented shift. In the energy sector, for example, investments in oil, coal and gas must decrease by about one-third by 2030, while investments in renewables and in energy efficiency must increase by at least a similar proportion if we are to keep average temperature rise below 2°C.

And the challenge is urgent: the decisions made in the next 2-3 years will determine the course of infrastructure for decades to come. Carbon pricing can play a crucial role by providing the signal, the tools and the financing to catalyze the monumental shift we need, at the pace we need it.

Ipek Gencsu is Research and Engagement Manager at the New Climate Economy.