Uncovering the Iceberg: Pricing Hidden Carbon Risks into Financial Portfolios

Originally posted by Navigant on July 31, 2019

Earth is steadfastly on its trajectory to above 3°C (or 37.4°F). If this happens, around $2 trillion of manageable assets would be at risk by 2100. But a global transition to a low carbon economy would unlock up to $26 trillion of economic gain by 2030 through GDP growth, job creation, and health benefits.

With much at stake and much to gain, why are so many financial institutions not using carbon pricing to reveal overvalued or undervalued assets? There are two key reasons—the materiality of carbon risks and how these risks can be integrated into decision-making.

Both issues can be explored with internal carbon pricing. Internal carbon pricing is an effective way to translate carbon risks and opportunities resulting from a company's or asset’s greenhouse gas emissions into monetary values. It is a tool for financial institutions to test and adjust the financial prospects of their investments and loans based on the results of climate scenario analyses.

Materiality: Are You Assessing It Right?

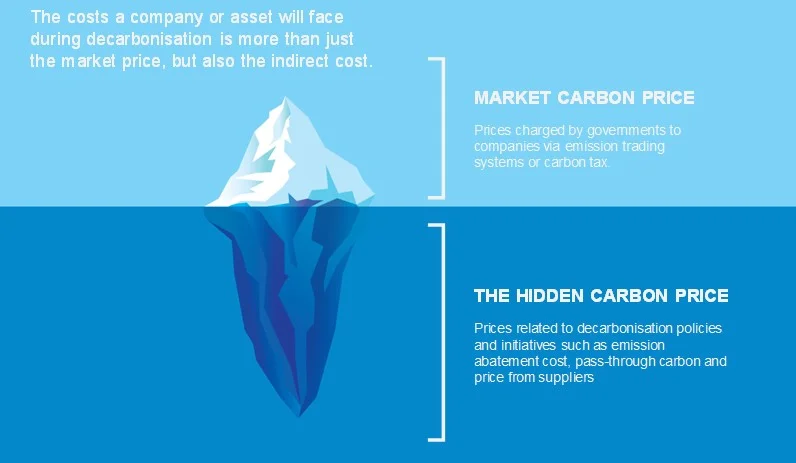

When it comes to putting a price on carbon emissions, financial institutions often think only of the market carbon prices, such as those charged directly to companies via emission trading systems or carbon taxes. However, materiality goes far beyond market carbon prices. The cost of carbon should also account for other costs throughout the operation and supply chain of companies (for example, emissions abatement costs, carbon price passed on by suppliers, and changes in revenue due to shifts in market demand). These may vary across sectors, regions, and asset classes, depending on financial exposure and time horizon.

Taking the right measurement requires looking into all types of carbon costs and ensuring investment or lending portfolios are resilient enough to absorb a range of prices, over time, across different scenarios.

Using Environment, Social and Governance Integration: How to Price Carbon Into Financial Portfolios?

Internal carbon pricing is a tool to flag risks and opportunities in various stages of investment or lending. For example, it can help investors evaluate the growth prospects of investments and banks analyze credit risk. For example, Garanti Bank applies a shadow price when evaluating projects in the energy sector—finding that the price could cause up to a 35% of change on the project’s earnings before interest, taxes, depreciation, and amortization. It is also a tool to engage investees or borrowers about climate risks.

Incorporating carbon risk assessment in decision-making is essential to portfolio resilience, as the effects of climate change may unfold exponentially and in an unexpected manner. Understanding the bigger picture of carbon risks is crucial to long-term financial stability. Navigant, the Generation Foundation, and CDP have developed a briefing paper, Internal Carbon Pricing for Low Carbon Finance. It has actionable insights and key information for investors and banks about using internal carbon pricing.